Guest Posts From: Yikai (jinyik.ai) is an independent builder and seed investor. He’s spent 10+ years in venture capital and played a key role in scaling an AI app company to ~$100M ARR.

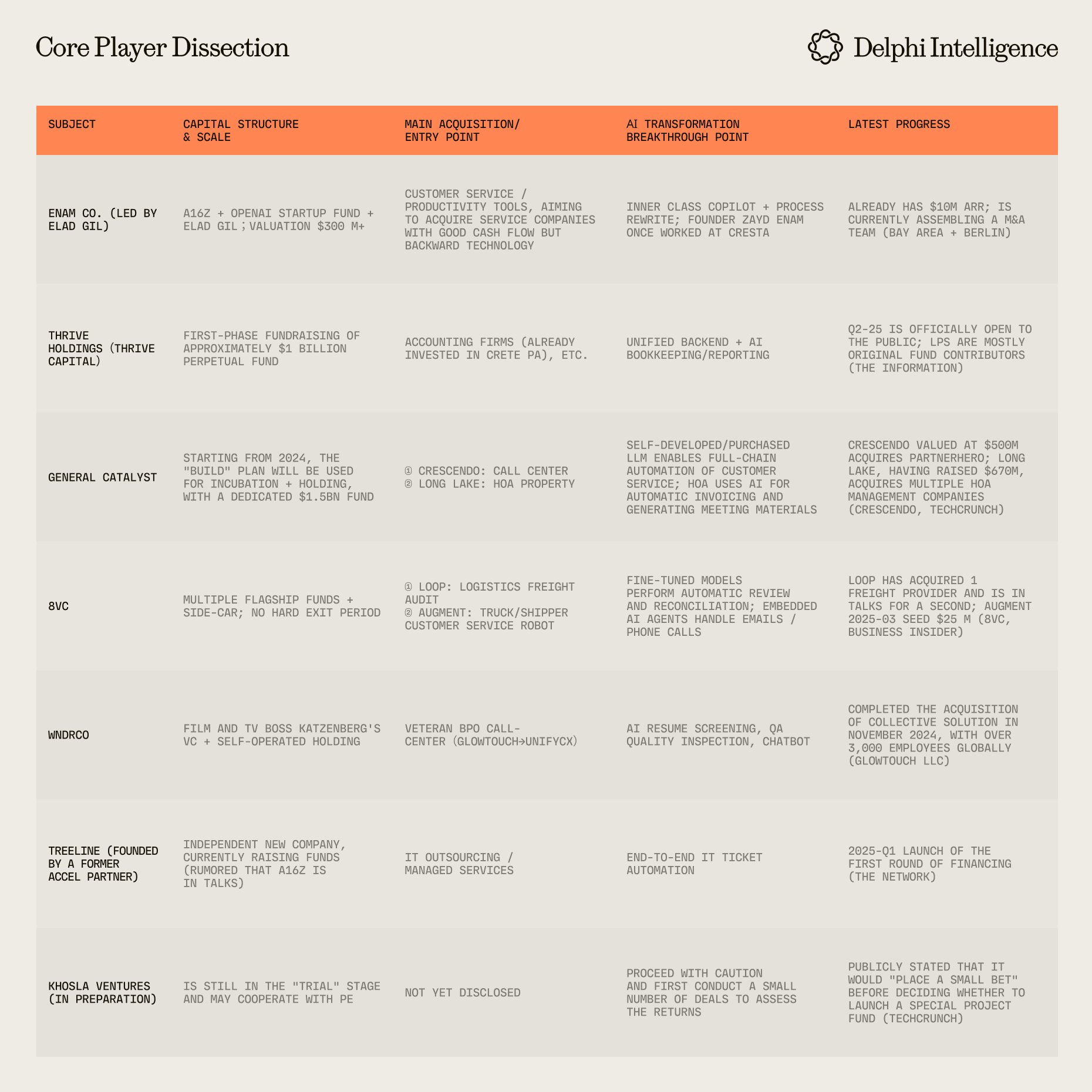

Recently, an increasing number of top Silicon Valley VCs/angels have begun to lead or bet on "AI-Roll-ups":

Elad Gil’s Latest AI Bet — The Information.pdf

Venture Capital’s Latest Strategy_ Private Equity–Style Roll-Ups — The Information.pdf

Thrive Capital Launches Vehicle to Buy and Hold Businesses — The Information.pdf

Khosla Ventures among VCs experimenting with AI-infused roll-ups of mature companies | TechCrunch

Overview of AI Rollup Strategy

- Playbook: First, establish a holding company or incubate/invest in a new entity → acquire traditional service industry businesses with high labor intensity and low software adoption → quickly embed LLMs + automated processes → increase EBIT / reduce labor, and then use the new cash flow to continue mergers and acquisitions.

- Underlying Logic:

- Penetration Rate Gap - Digitalization levels are low in areas such as bookkeeping, HOA property management, and call centers, where AI can immediately eliminate repetitive work hours;

- Controllable Downside Risk - If AI upgrades fall short of expectations, the underlying business remains a cash flow business, preventing it from going to zero;

- Low exit pressure - Most vehicles adopt a permanent/semi-permanent capital structure, allowing long-term holding without relying on IPOs.

Key Differences and Observations

Capital vehicle

- Thrive Holdings and General Catalyst Build are both permanent capital vehicles, which can be rolled over for mergers and acquisitions;

- 8VC / Elad Gil Preference Project-based SPV, Flexible Fundraising.

M&A Depth

- GC/Thrive aims to hold 30-45% of the shares and retain the founding/operating team;

- UnifyCX is taking the 100% buy-out + rebrand route.

AI Empowerment Model

- Process Automation Type (Accounting, HOA, IT Ticket): Embed LLMs into off-the-shelf ERP/CRM;

- Front Desk Customer Service Type (Call Center): Agent + HI model, first replace FAQ / routing, then gradually lay off employees;

- Data Network Effect Type (Logistics Reconciliation): Obtain industry data through mergers and acquisitions to iterate the exclusive model.

Early Effect

- Crescendo reduced labor/ticket costs by ~35% and increased NPS by 18 points within 9 months after the merger and acquisition;

- Long Lake reduces single HOA management fees by 20-25% and doubles Ebitda. (Crescendo, TechCrunch)

Risk Point

- Slow M&A integration: Before the AI capabilities are launched, the old team and new processes run in parallel, leading to a brief dip in cash flow;

- Elevated debt-to-asset ratio: If interest rates remain high, the interest on leveraged buyouts will consume most of the transformation dividends;

- Valuation anchor is blurred: Traditional PE uses EBITDA, while most AI-roll-ups still use ARR/Tech-multiple to communicate with LPs, potentially leading to misalignment.

Summary of Phenomena

- The trend has gained momentum: From individual angels (Elad Gil) to platform VCs (Thrive, GC, 8VC) to cross-industry funds (WndrCo), all are viewing AI as an "immediate" EBITDA amplifier after mergers and acquisitions.

- Investment Approach Differentiation: Permanent capital + multi-year rolling mergers and acquisitions (GC/Thrive) are more like micro-PE; project-based + deep vertical categories (8VC/Elad) retain VC flexibility.

- Short-term indicator: Whether we can see ≥30% reduction in headcount + ≥2× EBITDA improvement within 12-18 months after the merger and acquisition is the new acceptance criteria for whether LPs will make additional investments.

- Future Highlights:

- Vertical SaaS companies (such as legal and medical billing) will be accelerated and reshaped by "expanded external services + built-in AI";

- Ordinary VCs may be forced to follow up, otherwise they will miss out on new channels for stable cash returns;

- If the Federal Reserve cuts interest rates, the cost of leveraged buyouts will decline, and this model may usher in the second wave of M&A climax.

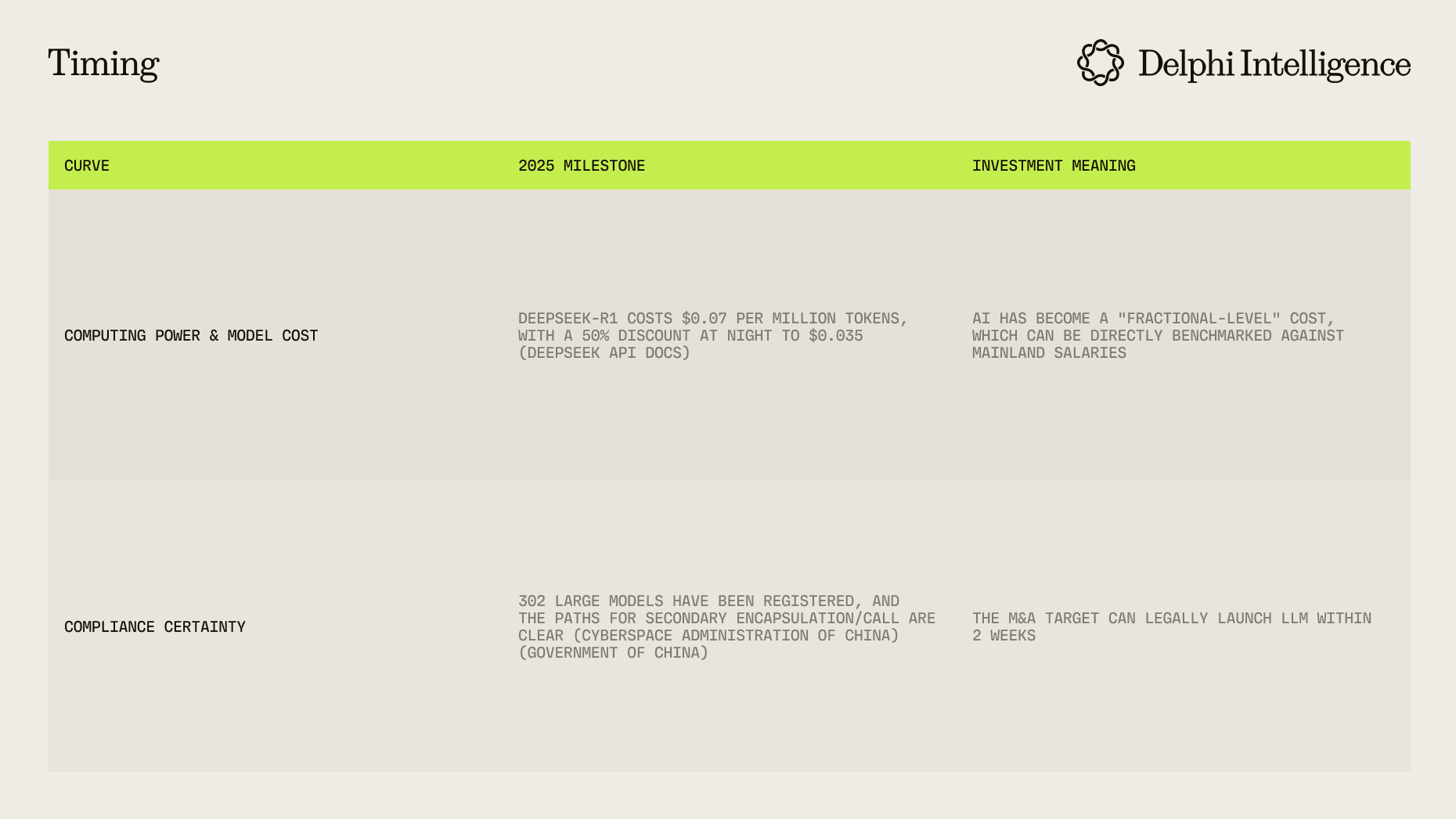

Why Now?

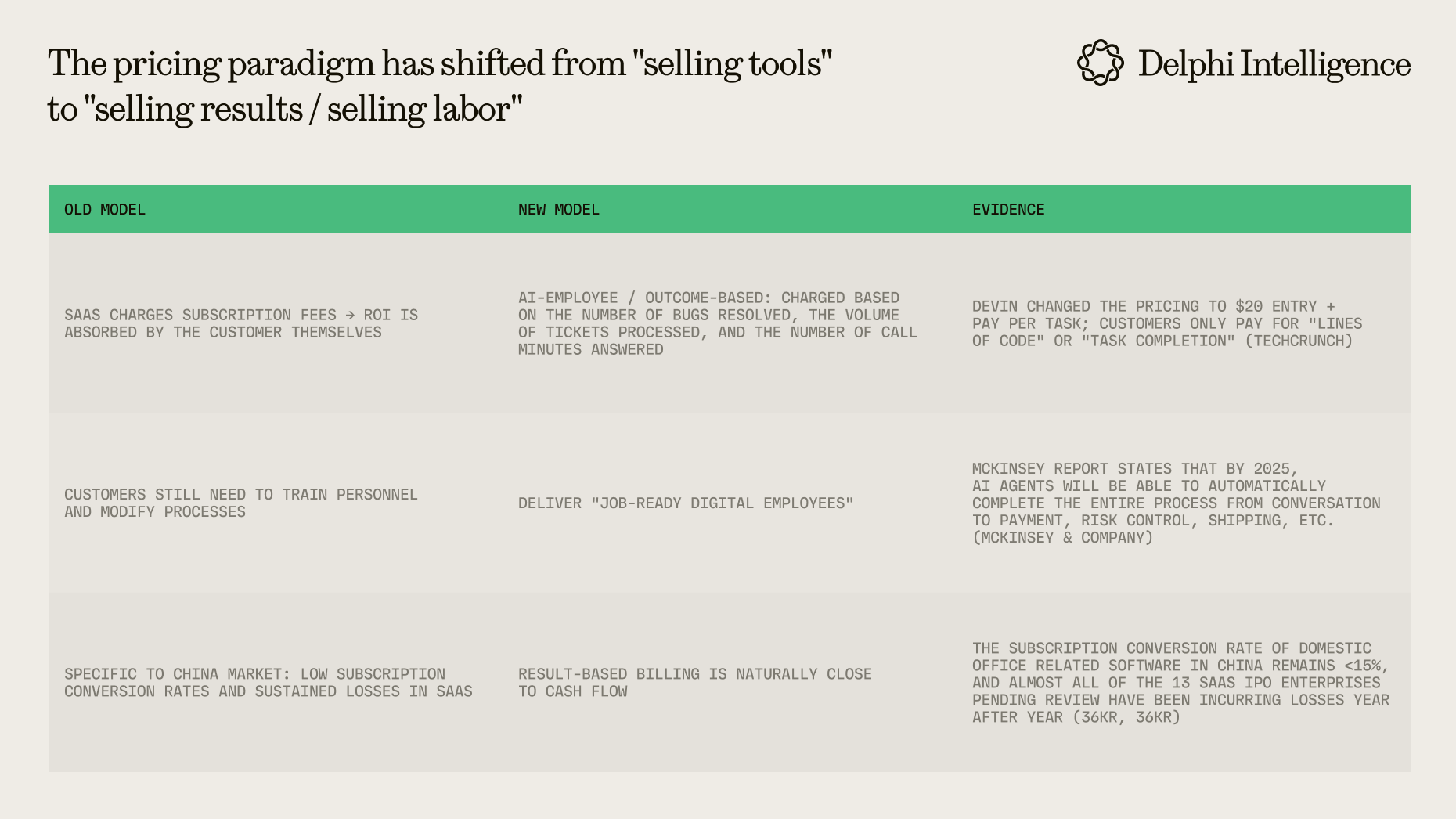

Thesis: Directly convert "saved labor" into a unit of measurement, making ROI immediately visible; no longer relying on increasing the in-app purchase conversion rate, a problem that Chinese SaaS has been unable to solve for 10 years.

Thesis: All "bills / calls / tickets" in these industries are Structured Data, and AI transformation does not require hardware; simply relying on LLM + RPA can cut labor costs in half.

Thesis: All "bills / calls / tickets" in these industries are Structured Data, and AI transformation does not require hardware; simply relying on LLM + RPA can cut labor costs in half.

Conclusion

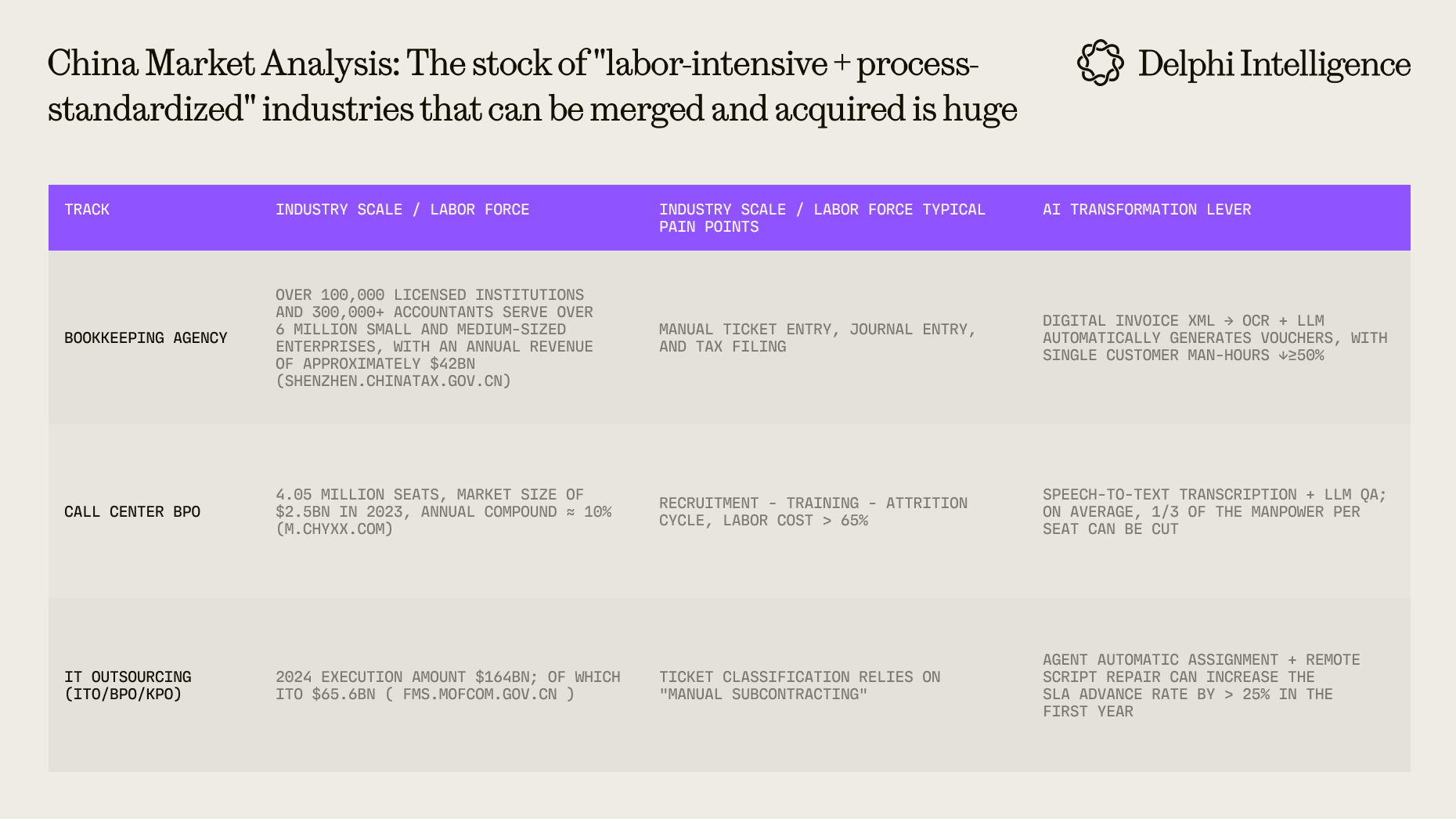

- Large market size: Just in the two sectors (agency bookkeeping and call center), the EBITDA pool available for mergers and acquisitions exceeds $5.6bn in China;

- Efficiency improvement is fast enough: LLM has already pushed the marginal computing power price down to a few cents, and for the first time, "1 yuan of computing power is equivalent to 1 yuan of salary" has become a reality;

- Low enough risk: In 2025, with interest rates at a new low, regulations clear, and data highly digitized, AI-roll-up is a win-win scarce strategy.

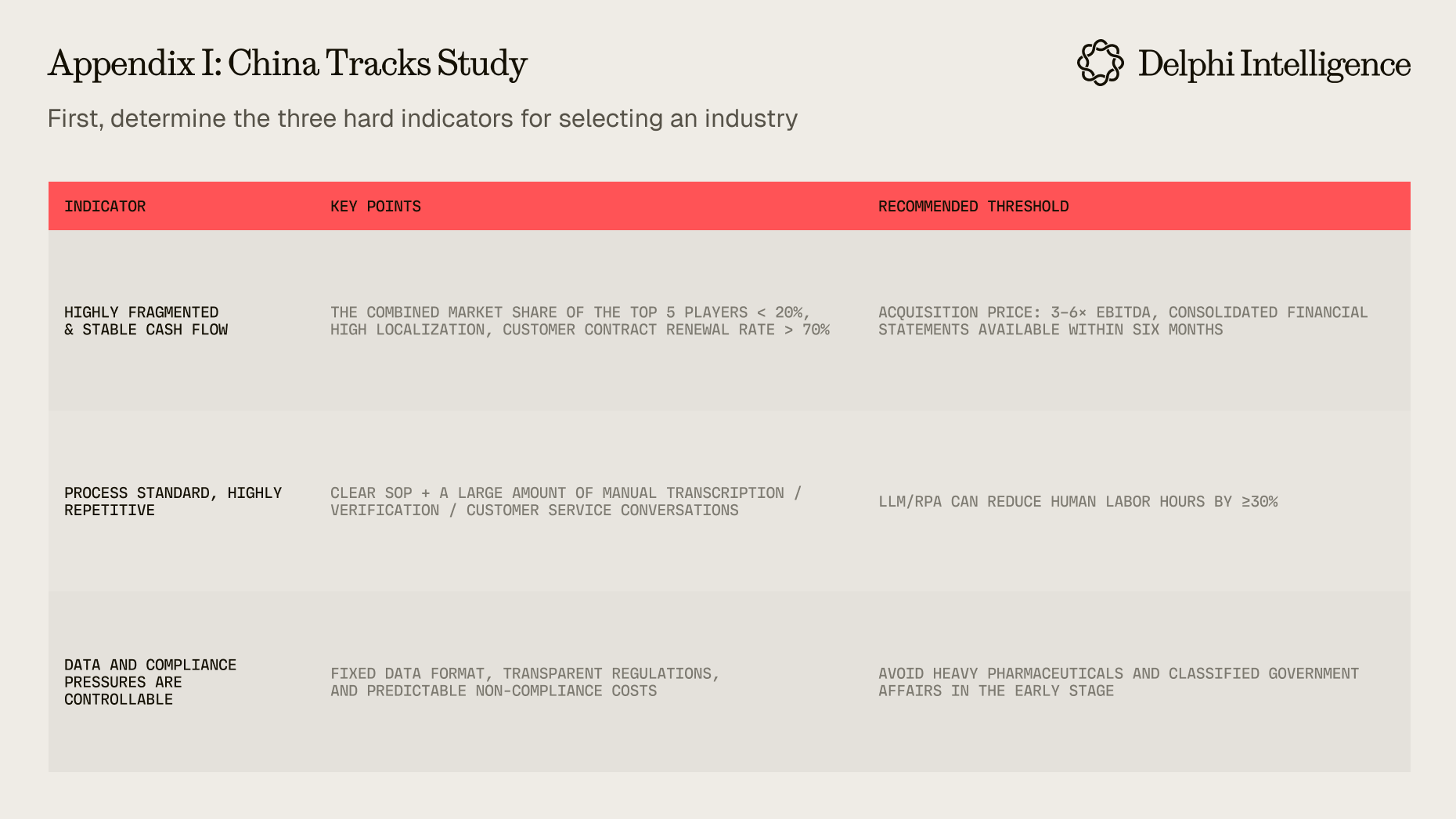

Appendix I: China Tracks Study

First, determine the three hard indicators for selecting an industry

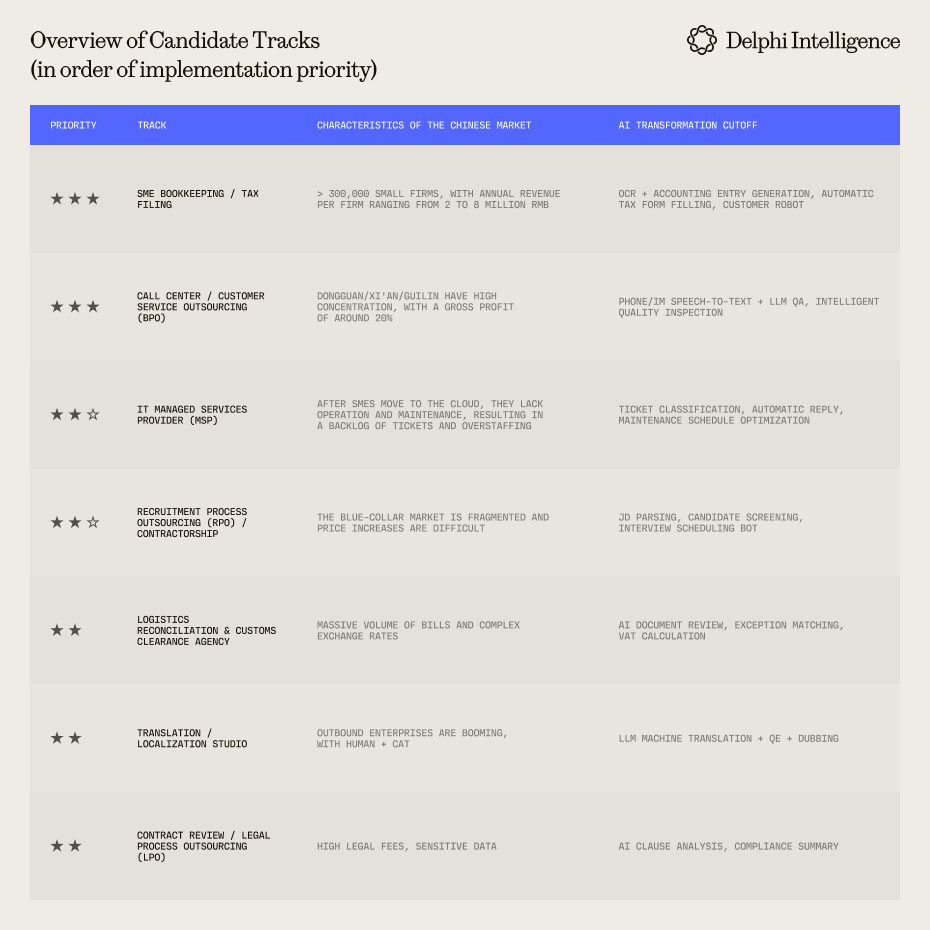

Other optional directions

- Educational Training Backend Academic Affairs Operation: Course Scheduling, Assignment Grading Assistant; Policy with High Periodicity

- Online travel agency customer support: Transform the refund, change, and cancellation process; capable of handling cross-border multilingual services

- Video Surveillance Center (VSaaS): Security AI + Manual Inspection; High hardware procurement costs and high self-owned cloud costs

Summary

- bookkeeping ≈ fastest positive cash flow; call center ≈ fastest significant improvement in staff efficiency, making it most suitable for building an MVP.

- choose categories with high standardization, clear regulations, and high customer stickiness, and conduct 1–2 POCs before getting involved.

.png)